When Good Benefits Go Bad: Rethinking Employer Health Plans

- Guest Writer

- Jul 9, 2025

- 3 min read

Updated: Aug 12, 2025

Written by Josh Surber, Sales Executive - Employee Benefits

Healthcare costs are spiraling out of control, and traditional employer health plans are failing the very people they're meant to protect. With 55% of Americans relying on employer-sponsored health insurance ¹, we're facing a crisis that demands immediate attention and innovative solutions.

The Problem: When Benefits Become Barriers

Recent Kaiser reports project a 7% increase in employer-sponsored health insurance premiums - yet another painful reminder that our current system is unsustainable. But the real shock comes when you look at what employees are paying and what they can afford. ²

According to the 25th Employer Health Benefits Survey ² :

Here's where it gets worse. The average deductibles employees face is $1,735 for individual coverage and $3,900 for family coverage.

Now consider this sobering reality ³ :

We've created a system where employees pay thousands for insurance they literally cannot afford to use.

The Devastating Consequences

When employees do need care - and they must use it - the results are catastrophic:

As an employee benefits broker working across industries, I witness this disconnect daily. Every employer I meet takes pride in their benefits package and genuinely cares about their employees' wellbeing. Yet we've collectively designed a system that's increasingly expensive to obtain and statistically impossible to afford when used.

This backward approach demands a fundamental rethink.

Strategic Solutions That Actually Work

Fortunately, there are proven ways to restructure health benefits that incentivize healthy choices while making coverage truly affordable when needed.

Focus on Chronic Condition Management

While biometric screenings remain important, managing existing conditions delivers far greater impact. With 60% of American adults living with at least one chronic disease and 40% managing multiple conditions ⁶, targeted support programs show measurable results.

The statistics are compelling: 80% of healthcare spend comes from members with chronic conditions ⁷. HealthCheck 360 shows that clients with an incentivized condition management program spend $2,500 less per member per year than clients that do not.

Consider implementing:

Condition-specific compliance programs

Medication assistance programs

Educational resources that help employees manage ongoing health rather than just detecting new problems

Price Transparency with Shared Savings

New programs incentivize employees to shop for planned procedures by sharing the savings when they choose cost-effective providers. Here's how it works:

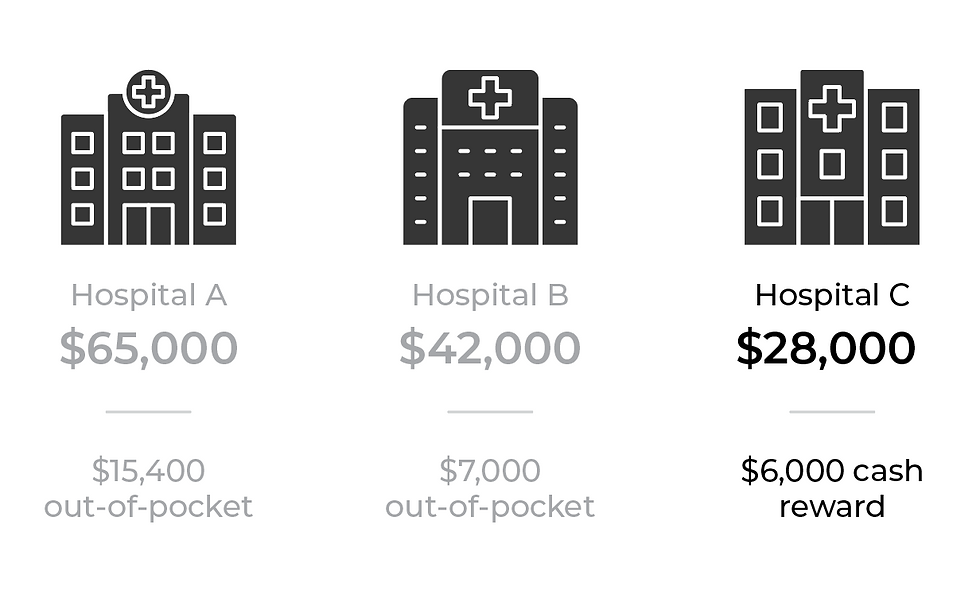

Sarah needs a knee replacement and discovers three options through her employer's price transparency program with her $3,000 deductible and 20% coinsurance.

Result: Sarah gets the same quality care while coming out $6,000 ahead. The plan saves money, and the employee wins big.

Copay-Only Health Plans

These streamlined plans eliminate the complexity of deductibles and coinsurance, replacing them with straightforward copayments. Coverage extends beyond basic preventive care to include generic medications, primary care visits, and essential services.

Most importantly, variable copay tiers reward cost-effective healthcare decisions with lower out-of-pocket costs. This approach reduces financial complexity while aligning employee incentives with smart healthcare spending.

A Call to Action

We can no longer treat health insurance as just another expense to negotiate down by a few percentage points each year. It's time to view employee health benefits as a strategic program that requires careful consideration of structure, function, and cost-sharing.

The current system is broken. Employees are paying more for coverage they can't afford to use, leading to financial ruin when they need care most. As employers, we have both the opportunity and the responsibility to do better.

I challenge every employer reading this: if you won't restructure your health benefits for your business's bottom line, do it for your employees who simply can't afford the status quo anymore.

The solutions exist. The question is whether we'll have the courage to implement them.

Interested in learning more? Contact Us!

| Josh Surber JSurber@cottinghambutler.com 847.447.7010 ext 2104 |

References:

Health Insurance Statistics & Facts 2025 - Forbes Advisor

https://www.forbes.com/advisor/health-insurance/health-insurance-statistics-and-facts/

25th Employer Health Benefits Survey - KFF

https://www.kff.org/report-section/ehbs-2023-summary-of-findings/

Most Americans can't afford a $1,000 emergency expense - CBS News

https://www.cbsnews.com/news/saving-money-emergency-expenses-2025/

The burden of medical debt in the United States - Peterson-KFF Health System Tracker

Medical Bankruptcies by Country 2025 - World Population Review

https://worldpopulationreview.com/country-rankings/medical-bankruptcies-by-country

Chronic Disease Prevalence in the US - CDC.gov